Where To Sign Stock Transfer Form – The form of a stock transfer can be used when the owner of the share wants to transfer the share to another owner. Shares are identifiable, fixed units of capital . They are the ownership stake of an owner in a company. Shareholders can sell them to someone else by way of gift or by sale. In either case, they require the signatures of at minimum at least two directors together with the secretary. The estate of the deceased must fill out the Inheritance Tax Waiver along with a stock transfer form.

Shares are identifiable fixed units in capital. They are the percentage of a stake owned by a

By purchasing shares of a company does not mean that you are a shareholder in the company. Your stake is all yours however, not having any additional obligations or obligations. But, you do have the ability to vote at company’s elections and shares can be an excellent method to exercise this right. Shareholding in a company is dependent on the percentage of the company’s owners compared to the amount of shares that are issued. Shareholders who hold less than 50 percent of shares of the company are in a position to exert considerable influence through the terms of a shareholder’s agreement.

Giving stocks away is an easy way to gift the recipient a portion that is part of your collection. Giving stock shares might require you to transfer ownership of the stock to your brokerage account and into the account of the recipient. You’ll need to speak with your broker prior to making the transfer, but this process can be carried out in a regular. Here are steps on how to give stock to an individual. Here are some reasons for giving stock.

They are tax-free

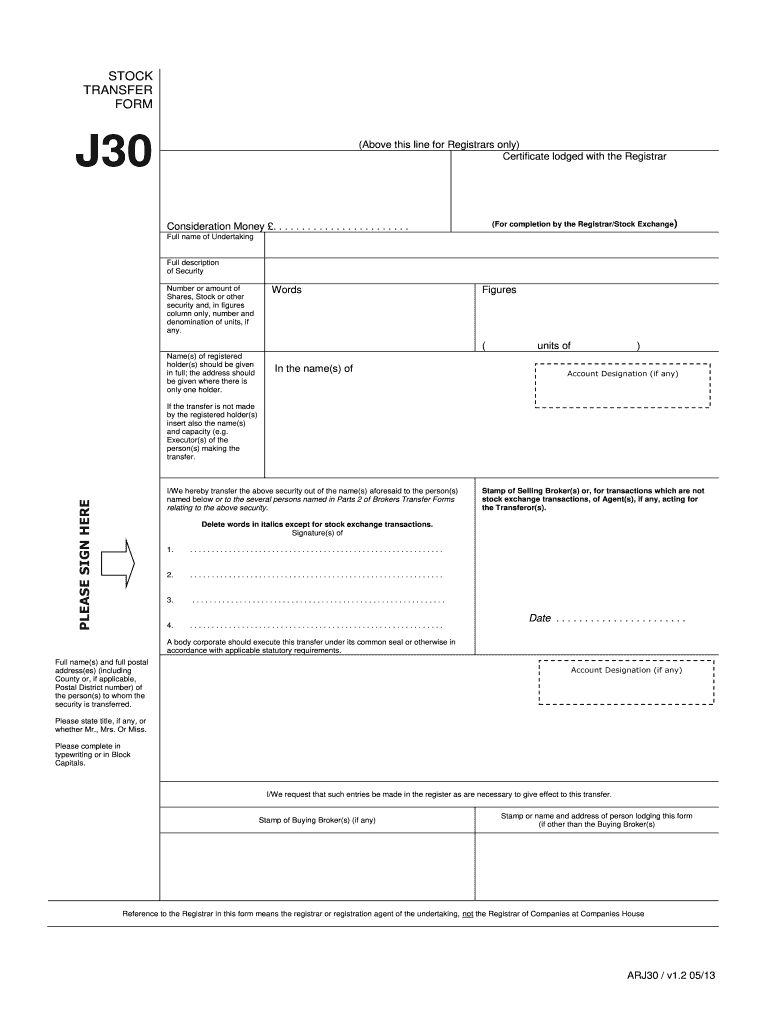

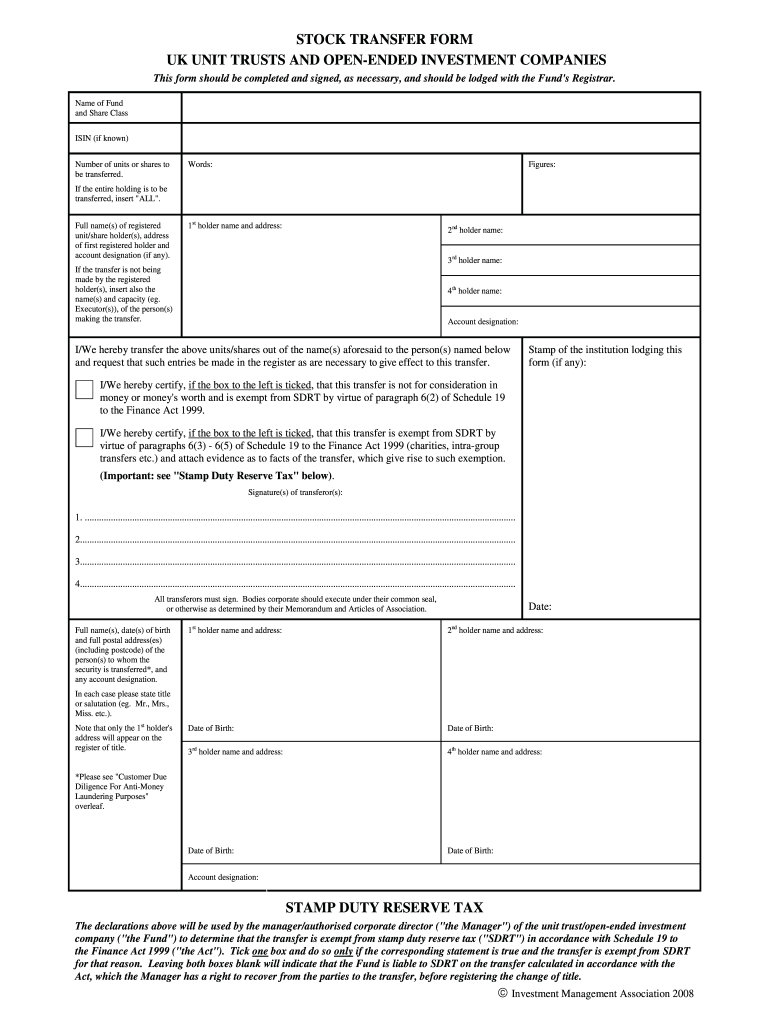

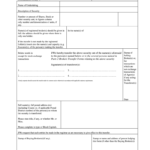

If you decide to sell or transfer stocks, you must complete a Stock Transfer Form. While this form cannot be part of your tax return the form contains details regarding the stock you own. This information is necessary to calculate your cost basis and the time period of holding. There are two types of forms to use for this. In addition to Stock Transfer Forms, you could also need an IRS Form 1099B, which is known as Proceeds from Broker or Barter Exchange Transactions.

They need the signatures of two directors and one secretary.

Any time a share deal takes place and shares of a company must have the signatures of an at-least two directors as well as a secretary. Share transfer forms are often used in the division process of firms or in sharing shares with partners. These officers’ signatures should be recorded on the stock transfer form to prevent disputes and ensure that the documents are true. These signatures can be on facsimile.

They can be sent to HMRC through the internet.

There are two main kinds of stock transfer form. Both require signatures of the signatories of “wet ink” to be valid. Form J10 is designed for shares that do not have a value or are partially paid. This form requires both the signatories to be present. Form J30 is for shares that are completely paid for and require only the transferor’s signature. In the end, the J30 form is the most used form of form for stock transfers.